Firms in PNG urged to deal with forex responsibly

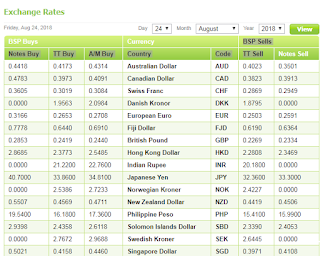

BANK of Papua New Guinea Governor Loi Bakani has urged private sector firms to act responsibly as the foreign exchange market improves.

This call also included foreign exchange dealers in regards to ensuring that only current import orders were brought to the market and companies to refrain from front-loading future import orders.

Bakani said this in the Quarterly Economic Bulletin March Quarter 2018 yesterday, which also contains economic updates.

“The bank anticipates that foreign exchange inflows will continue to improve to reduce this imbalance,” he said.

“Current import orders should be met at a reasonable timeframe.

“With improvements in the international commodity prices and the recommencement of production of two major mines and the LNG project following the earthquake in February 2018, foreign exchange inflows have improved significantly.

“In July, foreign exchange inflows had reached the levels of 2017, mainly reflecting higher production by OK Tedi and Porgera mines and the LNG project, coupled with the commencement of corporate tax payments to the Government by the operator of PNG LNG project.

“In addition, the final drawdown of US$190 million (K629mil) of the Credit Suisse Syndicate Loan in June 2018 also assisted in providing the necessary foreign exchange.

“Other inflows expected in the coming years include the Budget support loans from the Asian Development Bank (ADB) and the World Bank.

“The first component of ADB loan of US$100 million (K331mil) is being drawn down in August, while the US$150 million (K496mil) of the World Bank loan is expected to be drawn down after the approval by the World Bank board.

“Out of the Credit Suisse loan, a total of US$143.8 million (K47mil) was used by BPNG to intervene in the foreign exchange market.

“The bank plans to utilise future inflows to support and clear import orders.”

This call also included foreign exchange dealers in regards to ensuring that only current import orders were brought to the market and companies to refrain from front-loading future import orders.

Bakani said this in the Quarterly Economic Bulletin March Quarter 2018 yesterday, which also contains economic updates.

“The bank anticipates that foreign exchange inflows will continue to improve to reduce this imbalance,” he said.

“Current import orders should be met at a reasonable timeframe.

“With improvements in the international commodity prices and the recommencement of production of two major mines and the LNG project following the earthquake in February 2018, foreign exchange inflows have improved significantly.

“In July, foreign exchange inflows had reached the levels of 2017, mainly reflecting higher production by OK Tedi and Porgera mines and the LNG project, coupled with the commencement of corporate tax payments to the Government by the operator of PNG LNG project.

“In addition, the final drawdown of US$190 million (K629mil) of the Credit Suisse Syndicate Loan in June 2018 also assisted in providing the necessary foreign exchange.

“Other inflows expected in the coming years include the Budget support loans from the Asian Development Bank (ADB) and the World Bank.

“The first component of ADB loan of US$100 million (K331mil) is being drawn down in August, while the US$150 million (K496mil) of the World Bank loan is expected to be drawn down after the approval by the World Bank board.

“Out of the Credit Suisse loan, a total of US$143.8 million (K47mil) was used by BPNG to intervene in the foreign exchange market.

“The bank plans to utilise future inflows to support and clear import orders.”

Post a Comment